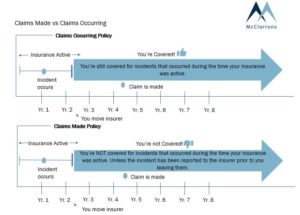

Whether a claim is valid and accepted depends on numerous factors, including the period of time your policy covers you for. Insurance policies are generally renewed annually so you might expect the period of time it covers to be 12 months but this is not always the case. Policies can be written in two ways – on a ‘claims made’ basis or a ‘claims occurring’ basis.

So, how does a ‘claims made’ policy work?

A ‘claims made’ policy will pay out for valid claims made during the (typically 12 month) policy period, regardless of when the incident or alleged breach of duty actually occurred.

Typically, both Professional Indemnity and Directors & Officers Liability policies are written on this basis. However, a number of insurers are now providing Abuse and/or Medical Malpractice cover for both domiciliary care and care home providers on a ‘claims made’ wording as well. This means all your work is covered as far back as the start date of the policy or the retroactive date*, if your policy has one.

*A retroactive date is the date from which you have held uninterrupted insurance cover (even if you happened to change insurer during this time) or a date in the past from which your insurer has agreed to cover you. Any claims that arise from events prior to this date would not covered by your insurance.

Depending on your retroactive date, this could mean your current ‘claims made’ policy could cover you for claims made during the policy period, which arise out of work you have done over a number of previous years.

It’s important to be aware that a ‘claims made’ policy can sometimes pay out in relation to claims made after the end of the policy period; this could be the case if your insurer has accepted a valid notification of circumstances during the lifetime of the policy. This is a really important point to bear in mind, particularly if you are considering changing insurer. Below, we share an example of how this might work.

Example

A care home is in month 11 of their policy and becomes aware that the family of one of their residents believes the company has not been administering crucial medications.

No claim has yet been made but it’s looking probable. The care home sees that the M.A.R system had not been completed for the resident. Although they are still trying to resolve the matter with their client, the care home notifies these circumstances to their insurer – no action is required at this time but the risk of a claim being made in the future is accepted by the insurer.

The care home decides to switch insurer from month 1 of the next policy year as there is a saving in premium. As requested during the quotation process, they notify the new insurer of the outstanding issue. This issue will now be specifically excluded by the new policy. However, this isn’t a problem as the previous insurer will cover the care home for any claim that is made in the future (i.e. after the policy period) relating to those circumstances already notified.

Crucially, had the care home not notified the previous insurer of the incident, it would have been very unlikely any cover would be provided in the event of the later claim being made.

So, how does a ‘claims occurring’ policy work?

Alternatively, your policy may be written on a ‘claims occurring’ basis’; this means it will only pay out for claims that arise out of loss or damage that actually happens during the (typically 12 month) policy period. It will even cover claims for loss or damage that occurs during the policy period but that isn’t realised until a much later date.

Typically, both Public and Employers’ Liability insurance are written on a ‘claims occurring’ wording. Public Liability often covers abuse allegations and can sometimes, by extension, the treatment cover for both domiciliary care and care homes.

For example, abuse allegation claims tend to be historical in nature. If an allegation is made of abuse which occurred 10 years prior, and the insurer at the time of the incident provided cover on a ‘claims occurring’ wording, it is that insurer who would then cover the claim.

Why is it so important for you to understand the terms of your policy?

Although not always the most fun, it goes without saying that we should all read our policy documents to ensure we understand the terms and the cover we have in place.

It can sometimes be the case that two insurance products are called the same thing – for example, Medical Malpractice, and that both are written on a ‘claims made’ basis but that they cover different things and work quite differently. Different insurers have different wordings and so it’s important that you understand the wording used so that the cover you require is provided should you claim.

It is also incredibly important to note that a change from a ‘claims made’ to a ‘claims occurring’ policy can cause a gap in coverage. This is just one of the reasons why it is so important to have a relationship with an insurance broker who specialise within the Care & Social Welfare sector, giving you peace of mind around your protection.

For more information or to arrange an independent review of your insurances, please do not hesitate to contact the Care & Social Welfare Team at McClarrons on 01653 600477.

SOURCES:

https://www.hiscox.co.uk/business-insurance/faq/claims-made-vs-claims-occurring