About Commercial Insurance

No business can afford to gamble with its protection, even if you carefully plan and prepare for the worst. If you face an unexpected problem, your Commercial Insurance will be invaluable.

Your bespoke cover will be managed by a dedicated contact who will handle your account, supported by an in-house claims management team to guide your business through any unforeseen eventualities.

Find Out MoreKey benefits

No two businesses are the same, which is why your Account Executive will work with you to gain a full understanding of your requirements, providing you with specialist and appropriate cover.

Risk management can highlight any current and future risks your business may face. We can arrange for a full assessment of your business and its operations, not only to advise on the insurance protection you require, but also to highlight and advise on potential safety hazards and issues.

At a glance

Liability insurance protects from claims caused by your negligence or omission.

Management liability covers your management team from potential disputes.

Business interruption protects from continual losses you face after an incident.

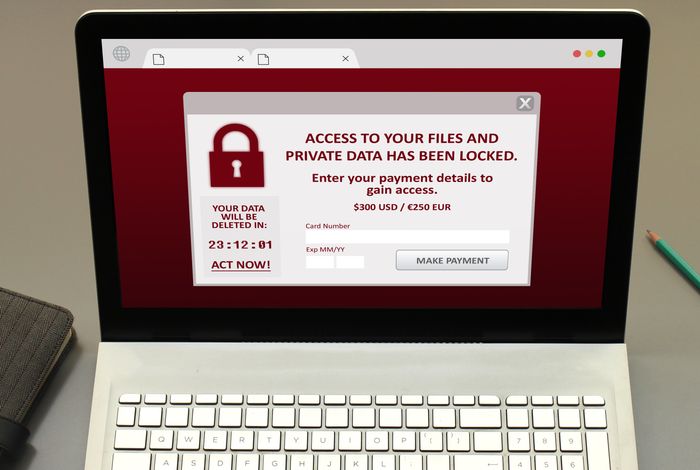

Cyber liability supports you for data loss to ransomware and more.

Personal service from the beginning

However unique or complex your situation may be, your dedicated contact will have specialist experience to be able to support you throughout your business insurance journey.

From the initial quote through to renewal, and including any claims you may have to make, you and your business will be supported with access to truly personal advice and guidance.

Contact usTestimonials

“McClarrons have supported us for a number of years. As a large employer within the domiciliary care sector we require comprehensive cover and support. They deliver what they promise and strive to offer a compelling service in a crowded market. They combine a thorough approach with strong knowledge of the different segments within the social care market. Importantly for us, they also maintain consistent account management. I recommend them.”

"I met Rhys networking and was impressed with how he spoke about the services McClarrons offer. After a thorough discussion about my insurance requirements, Rhys came to me with 3 offers that ultimately saved me 30% on the invited renewal premium of my previous broker, as well as significantly improving my cover. We didn’t just buy from Rhys and McClarrons because of the premium but due to his efficiency and quality of advice, coupled with the smooth, pain free quotation process. I wouldn’t hesitate to recommend Rhys to anyone and will be moving all of my business to McClarrons."

"We’ve used McClarrons for several years and have always been very impressed with their knowledge of the care and voluntary sector. As a community interest company, it’s vital we work with a broker who has a clear understanding of the voluntary sector. After a complete review of our insurances, McClarrons expanded our coverage as well as offering a saving when compared to our previous insurer. If we ever have an enquiry it is always handled professionally and turned around extremely quickly, it is great to work with a brokerage who truly practice what they preach in terms of customer service."